Retaining and Engaging Key Finance Talent: Strategies for Success

The modern economic landscape is characterized by an intensifying battle for specialized talent, and skilled finance professionals are particularly in high demand. Organizations across various sectors recognize the pivotal role that finance teams play in driving strategic decision-making, ensuring financial stability, and fostering sustainable growth. Key finance talent, encompassing individuals with deep expertise in areas such as financial analysis, accounting, risk management, and regulatory compliance, possesses specialized skills and knowledge that are not easily replaced. The loss of such individuals can create significant operational challenges and financial burdens for companies, underscoring the critical need for effective retention strategies.

This report delves into the multifaceted approaches that financial organizations can adopt to retain and engage their most valuable finance professionals. It will explore five key attribution factors that significantly influence an employee’s decision to stay with an organization: compensation, manager quality, respect, people management, and work-life balance. Furthermore, the report will examine the increasing role of technology in talent retention, with a specific focus on how social intranet features can be strategically leveraged to enhance the engagement and commitment of finance talent. Finally, recognizing that the adoption of new technologies often involves navigating a complex procurement process, the report will also address the common challenges companies face when purchasing SaaS products, particularly social intranets, and outline the essential qualities that a creative social intranet vendor should possess to ensure successful SaaS deployment.

The finance industry, operating within a framework of stringent regulations and handling highly sensitive data, places an even greater emphasis on the retention of experienced and trustworthy talent. The potential for errors or compliance breaches due to a lack of experience can have far-reaching and significant financial repercussions. Finance roles often require specific certifications, such as the Certified Management Accountant (CMA), and a profound understanding of intricate regulations. Consequently, losing an employee with this level of expertise not only creates a gap within the team but also elevates the risk of non-compliance and potential financial missteps. This reality underscores the paramount importance of implementing targeted and effective retention strategies specifically tailored to the finance sector.

Moreover, the finance sector is experiencing a rapid transformation driven by technological advancements, including the integration of artificial intelligence (AI) and automation into various financial processes. This evolution necessitates a finance workforce that is not only proficient in traditional financial skills but also adaptable and eager to embrace new technologies and methodologies. Retaining talent who already possess these skills or demonstrate a strong willingness to learn and develop them is crucial for financial organizations to maintain a competitive edge in an increasingly digital landscape. Retention efforts should therefore prioritize providing ample opportunities for upskilling and continuous professional development to ensure that finance teams remain at the forefront of these technological changes.

Employee turnover, particularly among key finance talent, carries substantial costs that extend beyond the immediately apparent expenses of recruitment and hiring. Organizations must recognize the full spectrum of financial and operational impacts to fully appreciate the importance of investing in robust retention strategies. Direct costs associated with employee turnover include the expenses incurred in the recruitment process, such as advertising, agency fees, and the time spent by HR and hiring managers on sourcing and interviewing candidates. Following the hiring stage, onboarding and training new employees represent further significant investments of both time and resources.

Beyond these direct financial outlays, employee turnover also generates a range of indirect costs that can significantly impact an organization’s overall performance. Decreased productivity is a common consequence, as new employees typically require time to reach the same level of efficiency as their predecessors. The loss of experienced finance professionals also leads to a drain of valuable institutional knowledge, which can affect the quality of financial analysis, reporting accuracy, and overall decision-making. Furthermore, high turnover can negatively impact the morale of remaining team members, potentially leading to decreased engagement and even further attrition. The potential for errors and inefficiencies due to inexperienced replacements also represents a significant indirect cost, particularly in the highly regulated finance sector.

Quantifying the financial impact of turnover reveals the significant burden it places on organizations. Research from the Society for Human Resource Management (SHRM) suggests that the cost to replace an employee can range from 50% to 60% of the employee’s annual salary, with overall costs, including indirect factors, potentially reaching anywhere from 90% to 200% of that salary. For a finance professional with a substantial salary, this translates to a considerable financial loss for the company. Lattice’s SOPS report indicates that compensation is the primary driver of employee turnover, with over half of employees leaving for jobs with higher pay. This highlights the importance of competitive compensation to mitigate turnover costs.

Moreover, the departure of key finance personnel can cause significant disruption to critical projects, leading to delays and potentially missed opportunities. For instance, the loss of a finance manager overseeing a crucial audit or a financial analyst involved in a strategic acquisition can severely impede progress and impact the organization’s strategic goals. The specialized skills and expertise held by these individuals are often difficult to replicate quickly, further exacerbating the negative consequences of turnover.

The financial services industry faces particularly high stakes due to the nature of its operations. Managing substantial financial assets and adhering to complex regulatory frameworks means that errors or decreased productivity within finance teams can have more pronounced financial repercussions compared to other sectors. Finance professionals are entrusted with critical functions such as financial reporting, risk management, and the development of investment strategies. Consequently, a decline in productivity or an error made by a new, less experienced employee can lead to significant financial losses or regulatory penalties for the organization.

Furthermore, high turnover within finance teams can erode the trust that stakeholders place in the organization’s financial management and reporting capabilities. It can also negatively impact relationships with vendors, particularly if key contacts and historical knowledge of past interactions are lost due to employee departures. Finance teams often serve as the primary point of contact for external auditors, investors, and crucial vendors. Consistent relationships, built on a foundation of trust and a deep understanding of past dealings, are vital for maintaining these partnerships and ensuring smooth operational flow. Turnover can disrupt these established relationships, creating uncertainty and potentially damaging the organization’s reputation and financial standing.

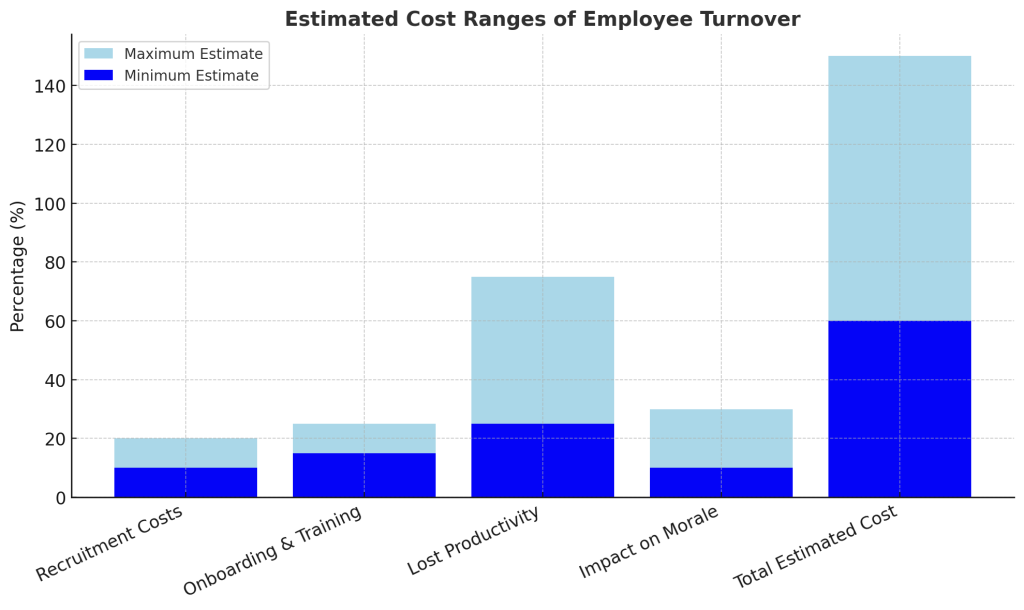

To illustrate the significant financial implications of finance talent turnover, the following table provides an estimated breakdown of the associated costs:

| Cost Category | Description of Costs | Estimated Range (of Annual Salary) |

|---|---|---|

| Recruitment Costs | Advertising, job board fees, agency fees, internal recruiter time | 10% – 20% |

| Onboarding & Training | New hire orientation, training programs, and manager time | 15% – 25% |

| Lost Productivity | Reduced output during the initial learning curve, errors by new hires | 25% – 75% |

| Impact on Morale | Decreased engagement of remaining employees, potential for further turnover | 10% – 30% |

| Total Estimated Cost | Sum of all categories | 60% – 150% |

Export to Sheets

Note: These are estimated ranges and can vary depending on the specific role, industry, and organizational factors. Data synthesized from.

This table underscores the substantial financial burden that finance talent turnover can impose on an organization. By quantifying these costs, it becomes evident that investing in proactive and effective retention strategies is not merely an HR imperative but a critical business decision with a significant return on investment.

Retaining and engaging key finance talent requires a comprehensive and strategic approach that addresses various aspects of the employee experience. Organizations must move beyond a singular focus on compensation and cultivate a supportive and growth-oriented environment.

Offering competitive salaries that meet or exceed industry benchmarks is a fundamental aspect of attracting and retaining skilled finance professionals. Finance roles often demand specialized expertise and carry significant responsibilities, justifying compensation packages that reflect their market value. Beyond base salary, bonuses and incentives tied to both individual and team performance play a crucial role in motivating finance talent and aligning their efforts with organizational goals. These performance-based rewards can serve as tangible recognition of their contributions and encourage continued excellence.

Furthermore, a comprehensive benefits package that includes robust health insurance, retirement plans, and other valuable perks is essential for attracting and retaining top finance professionals. These benefits provide employees with a sense of security and well-being, demonstrating the organization’s commitment to their overall welfare. The concept of pay parity, ensuring that employees in similar roles and with comparable experience receive equitable compensation across the organization, is also critical for fostering trust and preventing feelings of being undervalued. This is particularly important in finance, where analytical skills make pay disparities more readily apparent.

Increasingly, financial incentives beyond traditional salary and bonuses are gaining prominence in talent retention strategies. Stock options, retirement plan contributions, and profit-sharing arrangements can provide finance employees with a direct stake in the company’s success, fostering a sense of ownership and long-term commitment. While compensation is undoubtedly a primary driver for finance professionals, it is important to recognize that it is not the sole determinant of retention. A holistic approach that also considers non-monetary benefits, such as opportunities for professional development and a supportive work environment, is crucial for fostering long-term employee loyalty. Transparency in compensation practices can also significantly contribute to building trust and reducing any perceptions of inequity, which can be particularly important within finance teams that rely heavily on data and analysis. Open communication about how compensation decisions are made and the factors that are taken into account can foster a sense of fairness and trust, ultimately leading to higher levels of job satisfaction.

The quality of an employee’s direct manager has a profound impact on their overall job satisfaction and their decision to remain with an organization. Effective managers possess a range of key qualities, including strong communication skills, honesty, confidence in their team, and the ability to delegate tasks appropriately. These managers prioritize their people, foster a sense of purpose within the team, and encourage teamwork, ultimately contributing to the success of their employees. They also play a vital role in providing regular feedback, offering constructive criticism, and actively supporting the professional growth and development of their team members.

Organizations must recognize the importance of equipping their managers with the necessary leadership skills through targeted training and development programs. This investment in management quality can yield significant returns in terms of employee retention and engagement. Conversely, poor management practices can lead to negative consequences such as employee burnout, decreased morale, and ultimately, higher turnover rates.

In the finance sector, where accuracy and meticulous attention to detail are paramount, managers who can provide clear guidance and constructive feedback are particularly instrumental in developing competent and confident teams. Finance professionals often operate under pressure and are expected to meet tight deadlines. Effective managers who can clearly articulate expectations, provide timely and relevant feedback on performance, and offer consistent support can significantly mitigate stress levels and enhance overall team performance. Furthermore, given the ever-evolving nature of financial regulations and the rapid advancements in financial technologies, managers in finance organizations have a responsibility to foster a culture of continuous learning within their teams. They should actively encourage and facilitate opportunities for their team members to acquire new skills and knowledge, ensuring that the entire team remains competent, adaptable, and well-prepared to navigate the changing financial landscape.

Treating all employees with dignity and respect is fundamental to creating a positive and inclusive work environment. A respectful workplace is characterized by open communication, mutual trust, and a genuine appreciation for individual contributions. Cultivating such an environment has been shown to reduce employee stress, increase overall engagement levels, and improve productivity across the organization.

Employee recognition plays a powerful role in boosting morale and fostering loyalty within finance teams. Regularly acknowledging the hard work and achievements of finance professionals can significantly enhance their sense of value and belonging. For recognition to be truly effective, it should be timely, specific to the accomplishment, and, where appropriate, publicly acknowledged. Creating a culture that embraces inclusivity and values diversity is also essential for building a respectful workplace where all finance employees feel valued and have the opportunity to thrive.

Given the often high-pressure environment prevalent in the finance sector, cultivating a culture of respect can be particularly crucial in mitigating stress and preventing burnout among finance professionals. The demanding nature of many finance roles can lead to significant levels of stress. A workplace where employees consistently feel respected, valued for their contributions, and treated fairly is more likely to foster a supportive atmosphere that helps individuals effectively cope with the inherent pressures of the industry. Furthermore, recognition within finance can extend beyond purely monetary rewards to include acknowledgment of critical skills such as accuracy in financial reporting, exceptional problem-solving abilities, and significant contributions to maintaining regulatory compliance, all of which are highly valued within the industry. While financial incentives are undoubtedly important, recognizing these specific skills and contributions that are directly linked to the success and integrity of a finance team can be equally, if not more, motivating for finance professionals and serve to reinforce desired professional behaviors.

Effective people management practices are essential for creating a productive and engaging environment that encourages finance professionals to remain with their organizations. This includes clearly defining goals and setting realistic expectations for both finance teams and individual employees. When individuals understand what is expected of them and how their work contributes to the broader organizational objectives, they are more likely to be motivated and committed.

Regular and open communication between managers and their finance teams is also paramount. Creating channels for ongoing dialogue allows managers to stay informed about employee progress, address any concerns or challenges proactively, and foster a sense of transparency and trust. Furthermore, providing ample opportunities for professional development and career growth is a key element of effective people management. Investing in the skills and knowledge of finance professionals not only enhances their capabilities but also demonstrates the organization’s commitment to their long-term success, making employees feel more valued and invested in their future with the company. Empowering finance employees and fostering a sense of autonomy in their work can also significantly contribute to their job satisfaction and retention. When individuals feel they have ownership over their tasks and are trusted to make decisions, they are more likely to be engaged and motivated. Finally, effective people management in finance involves proactively managing workloads to prevent burnout and ensuring that employees maintain a healthy balance between their professional and personal lives.

In the finance sector, where regulations and procedures are subject to frequent updates, effective people management necessitates ensuring that finance professionals have consistent access to continuous learning and development opportunities to maintain their expertise and stay current with industry standards. The financial landscape is constantly evolving, and managers must proactively support their teams in staying informed and compliant by providing relevant training programs and resources. Moreover, given the collaborative nature of many finance functions, effective people management also involves actively fostering collaboration and knowledge sharing within the team. This allows for the collective expertise of the team to be leveraged, ensuring accuracy and efficiency in critical financial processes. Managers should strive to cultivate an environment that encourages teamwork, open communication, and mutual support among finance professionals.

In today’s demanding work environment, a healthy work-life balance has become an increasingly important factor for employee satisfaction and overall retention, and this is particularly true for finance professionals. The often intense and deadline-driven nature of finance roles can make it challenging for individuals to effectively manage their professional and personal lives. Organizations that recognize this and actively promote work-life balance are more likely to attract and retain top finance talent in the long term.

There are various strategies that financial organizations can implement to promote a healthy work-life balance among their finance teams. Offering flexible work arrangements, such as the ability to adjust start and end times or work compressed workweeks, can provide employees with greater control over their schedules. Remote work options, where feasible, can also significantly reduce commuting stress and provide more flexibility to manage personal commitments. Encouraging employees to take their allocated time off and ensuring that they feel comfortable doing so is also crucial for preventing burnout and promoting well-being.

The benefits of promoting a healthy work-life balance are numerous. It leads to increased job satisfaction among finance professionals, reduces stress levels, and improves both their mental and physical health. Conversely, neglecting work-life balance can result in increased burnout, job dissatisfaction, and ultimately, higher employee turnover rates. Given the demanding nature of finance roles, which often involve long working hours and significant stress, organizations that prioritize work-life balance demonstrate to their finance professionals that they genuinely value their overall health and well-being, which in turn fosters increased loyalty and commitment. Furthermore, a company with a reputation for supporting work-life balance is more likely to attract high-caliber finance talent, who are increasingly prioritizing their personal lives alongside their professional careers. This positive reputation can be a significant competitive advantage in the ongoing battle for top finance talent.

Social intranets have evolved from simple internal communication tools to sophisticated platforms that can play a strategic role in enhancing employee engagement and retention, including within finance teams. By integrating social networking capabilities with traditional intranet features, these platforms can foster a more connected, collaborative, and supportive work environment.

Social intranets offer a variety of features that can significantly improve communication and collaboration among finance professionals. Instant messaging tools allow for quick and direct communication, facilitating rapid problem-solving and information exchange. Discussion threads provide a platform for more in-depth conversations on specific topics or projects, allowing team members to share insights and perspectives. Shared workspaces enable finance teams to collaborate on documents, track project progress, and centralize relevant information, regardless of their physical location. These features are particularly beneficial for remote or hybrid finance teams, ensuring that all members stay connected and informed. The ability to collaborate effectively across different departments and manage projects efficiently is also enhanced through the use of social intranets.

In the finance sector, where the timely and accurate sharing of information is paramount for effective decision-making and regulatory compliance, social intranets provide a secure and efficient platform for disseminating critical updates and collaborating on sensitive financial documents. Finance teams often need to work together on confidential financial reports and analyses. A social intranet equipped with secure document sharing capabilities and robust communication features can streamline these essential processes while maintaining the necessary levels of data integrity and security. Furthermore, the functionality to create dedicated team or project spaces within a social intranet can significantly improve organization and focus for finance teams as they work on complex tasks, such as preparing for audits or completing regulatory filings. Finance projects frequently involve multiple stages and the contributions of various team members. These dedicated online spaces serve as a centralized hub for all relevant information, assigned tasks, and ongoing communication, thereby enhancing overall efficiency and reducing the potential for errors or oversights.

Social intranets offer valuable tools for recognizing and appreciating the contributions of finance professionals. Features such as public shout-outs allow managers and peers to acknowledge outstanding work and achievements, boosting morale and fostering a culture of appreciation. Peer appreciation features enable team members to recognize each other’s efforts, strengthening team bonds and promoting a supportive work environment. Formal awards programs can also be integrated into the social intranet, providing a platform to celebrate significant accomplishments and milestones. Making employee recognition visible across the organization can significantly enhance morale and reinforce a positive company culture. Social intranets can also be used to tie recognition to specific company values, further reinforcing desired behaviors and a sense of shared purpose.

Social intranets can provide a dedicated platform for recognizing finance professionals for their often-unseen but critical contributions, such as maintaining accuracy in financial records, demonstrating exceptional attention to detail, and playing a vital role in upholding financial integrity. While the daily tasks of finance teams may not always be publicly celebrated, their meticulous work is essential for the overall health and stability of the organization. A social intranet offers a channel through which managers and colleagues can specifically acknowledge these crucial contributions, ensuring that finance professionals feel valued and appreciated for their diligence. Furthermore, the integration of gamification features within social intranets can introduce an element of engagement and fun to employee recognition programs within the finance department. By incorporating elements such as points, virtual badges, and leaderboards, organizations can make employee recognition more interactive and motivating for finance professionals, who may appreciate a data-driven and goal-oriented approach to acknowledging their achievements.

Social intranets can serve as valuable platforms for facilitating learning and development opportunities for finance talent. They can be used to easily share a wide range of training materials, including documents, presentations, recorded webinars, and links to online courses. The collaborative nature of these platforms also supports peer-to-peer learning, allowing finance professionals to share their expertise, insights, and best practices with their colleagues. Many social intranets offer features that enable the creation of personalized learning paths, tailoring development opportunities to individual needs and career goals. These platforms can also track employee progress through training modules, providing valuable insights into the effectiveness of learning initiatives.

Social intranets can function as a central repository for all finance-specific training resources, ensuring that employees have convenient and readily available access to crucial information regarding new regulations, evolving accounting standards, and updates to financial software and systems. Given the dynamic nature of the finance industry, finance teams need to stay continuously informed about the latest changes in laws and accounting principles. A social intranet provides an easily accessible platform for housing and efficiently disseminating this vital information. Moreover, the inherent collaborative features of social intranets can foster a culture of continuous improvement within the finance department by allowing finance professionals to readily share their best practices, pose questions to their peers, and learn from the diverse experiences of their colleagues. Finance teams often encounter unique and complex challenges in their daily work. A social intranet facilitates internal knowledge sharing and collaborative problem-solving, enabling team members to leverage their collective expertise to find effective solutions.

Social intranets provide effective channels for gathering employee feedback and fostering a stronger sense of belonging among finance professionals. Features such as integrated surveys and polls allow organizations to solicit input on various aspects of the employee experience, including workload, processes, and management effectiveness. Discussion forums offer a space for open dialogue and the exchange of ideas, giving employees a voice and contributing to a more transparent and positive work environment. Social intranets also play a crucial role in building communities and fostering a sense of belonging, particularly for finance teams that may be geographically dispersed or working in hybrid arrangements.

Social intranets can establish anonymous feedback channels, allowing finance employees to voice concerns about sensitive issues such as workload distribution, operational processes, or management styles without fear of reprisal. In some finance organizations, the hierarchical structure might make employees hesitant to express their concerns directly. Anonymous feedback mechanisms embedded within a social intranet can provide valuable insights to leadership regarding potential issues that could be impacting employee morale and ultimately contributing to turnover. Furthermore, creating dedicated communities or interest-based groups within the social intranet specifically for finance professionals with shared responsibilities or common interests can significantly strengthen team bonds and cultivate a greater sense of camaraderie. Finance teams often work in close collaboration. An online community within the social intranet can extend these professional connections beyond formal work tasks, fostering stronger interpersonal relationships and a more supportive and cohesive team environment.

Social intranet platforms can be effectively utilized to communicate and promote various work-life balance initiatives within financial organizations, including flexible work policies and employee wellness programs. Features such as shared team calendars can facilitate the management of time off requests and the coordination of flexible work schedules, ensuring adequate team coverage while accommodating individual employee needs. Social intranets can also serve as a central repository for sharing valuable resources and practical tips related to employee well-being and effective stress management techniques.

By providing a centralized platform for information dissemination and streamlined communication, intranets can help to reduce the reliance on after-hours emails and phone calls, thereby enabling finance professionals to more effectively disconnect from work-related matters and maintain a healthier work-life balance. The constant connectivity facilitated by modern technology can often blur the boundaries between professional and personal time. A well-managed intranet can help to streamline essential communication during regular work hours, reducing the perceived pressure for finance employees to be available and responsive at all times, which ultimately supports their ability to achieve a better equilibrium between their work and personal lives.

The decision to invest in an intranet SaaS product is a significant one for any organization, and financial institutions must carefully navigate the procurement process to ensure they select a solution that meets their specific needs and avoids potential pitfalls.

One of the initial challenges in purchasing an intranet SaaS product involves having a clear understanding of the organization’s specific requirements and ensuring that these needs are effectively communicated to potential vendors. A lack of clarity regarding the desired features, functionalities, and overall objectives can lead to the selection of a platform that ultimately does not fully address the needs of the finance teams or the wider organization. Integration with existing IT infrastructure and business systems is another critical consideration. Seamless interoperability with tools already in use, such as financial accounting software, HR management systems, and communication platforms, is essential for maximizing the value of the intranet and avoiding data silos.

Security is a paramount concern, particularly for financial institutions that handle highly sensitive financial data. Therefore, robust data protection measures, including encryption, stringent access controls, and regular security audits, are non-negotiable requirements when selecting an intranet platform. The chosen platform must offer the scalability to accommodate the organization’s growth and evolving needs over time. Finally, the complexity of SaaS pricing structures can present a significant challenge. Financial institutions must carefully scrutinize pricing models to identify any hidden fees or potentially unpredictable costs associated with factors such as the number of users, data storage, or access to specific features.

Given the stringent regulatory requirements that govern the finance industry, security and compliance are paramount concerns when selecting an intranet SaaS product. Vendors must demonstrate a comprehensive understanding of these unique needs. Finance organizations handle highly sensitive financial data, making adherence to regulations such as GDPR and SOX critical. Any intranet platform under consideration must have robust security protocols in place and demonstrate full compliance with all relevant regulations to avoid potentially severe penalties and significant reputational damage. Furthermore, a failure to thoroughly investigate the specific use cases of end-users within the finance department and to adequately involve key stakeholders in the selection process can lead to the acquisition of a social intranet platform that ultimately does not effectively meet the day-to-day needs of finance teams. Finance professionals have distinct workflows and specific collaboration requirements that are often unique to their roles. If the chosen intranet platform does not align well with these established practices, user adoption is likely to be low, and the organization’s investment will fail to deliver the anticipated benefits.

Organizations may experience regret after purchasing an intranet SaaS product for various reasons. One common cause is a misalignment between the initial expectations set during the sales process and the actual capabilities and performance of the platform. This can occur if the organization does not fully understand the product’s limitations or if the vendor overstates its features and benefits. Another frequent source of regret arises from additional costs that were not communicated to the buyer upfront. These unexpected expenses, which may be related to implementation, training, or access to certain features, can quickly erode the perceived value of the SaaS solution. Poor communication from the vendor during the sales and subsequent implementation phases can also lead to buyer’s remorse, leaving the organization feeling unsupported or ill-prepared to utilize the new platform effectively. Delays in the implementation timeline and a lack of adequate ongoing support from the vendor are other significant factors that can contribute to post-purchase regret. Finally, organizations may experience regret if they fall victim to “shiny object syndrome,” being swayed by the latest trends or features without fully assessing whether the chosen intranet truly meets their core business needs.

In the finance sector, where precision and reliability are of the utmost importance, delayed implementation or a lack of responsive and knowledgeable support for an intranet platform can severely disrupt critical financial processes. Finance teams often operate under strict deadlines, such as month-end and year-end closing periods, as well as various regulatory reporting requirements. Any significant delays in the implementation of a new communication and collaboration platform, or a lack of timely support when technical issues arise, can severely hinder these essential workflows and potentially lead to compliance challenges. Furthermore, the intricate nature of financial regulations might lead to buyer’s remorse if the chosen intranet vendor lacks the necessary expertise to effectively address finance-specific compliance requirements or if the platform does not offer sufficient customization options to meet these unique needs. Generic intranet solutions that are not specifically tailored to the finance industry may fall short in providing the features and functionalities required to maintain compliance and effectively manage financial information. Organizations may subsequently regret selecting a vendor that does not possess the necessary depth of understanding or the flexibility to adapt to the specific demands of the finance sector.

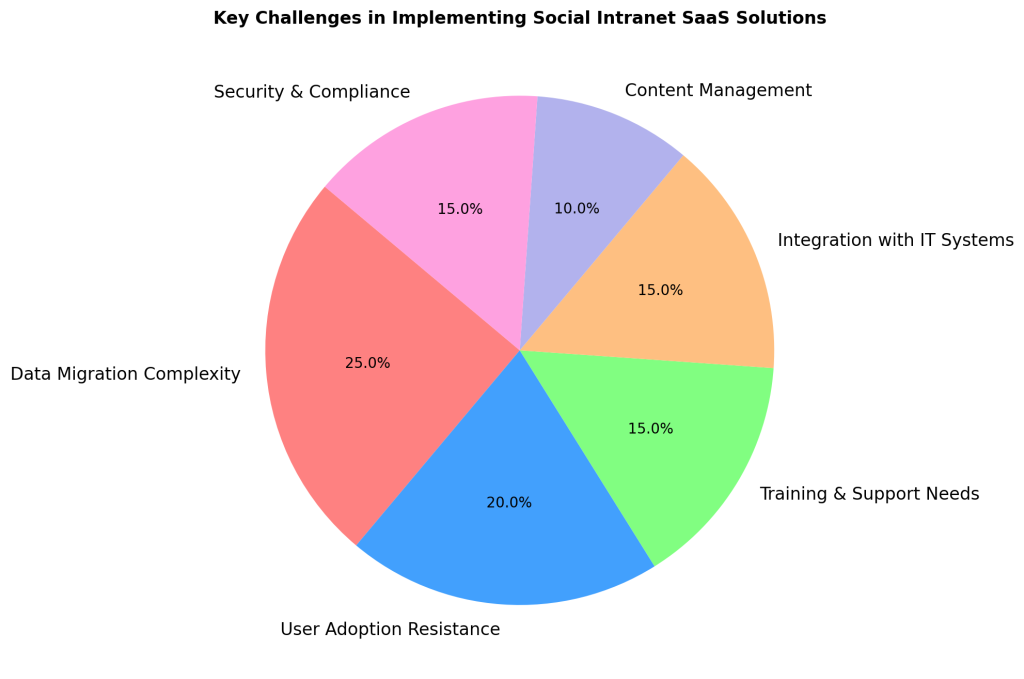

The implementation of an intranet SaaS solution can present several challenges for financial institutions. One common hurdle is the migration of data from existing legacy systems to the new platform. This process can be complex and time-consuming, particularly when dealing with large volumes of sensitive financial data that must be transferred accurately and securely. Ensuring high user adoption across the organization and overcoming potential employee resistance to adopting a new communication and collaboration platform is another significant challenge. This is especially true for finance professionals who may be accustomed to more traditional methods of communication. Adequate training and ongoing support for all employees are crucial for facilitating a smooth transition and ensuring that everyone can effectively utilize the features of the intranet. Achieving seamless integration with the organization’s existing IT infrastructure and other critical business applications is also essential for maximizing the platform’s value and avoiding disruptions to established workflows. Finally, the ongoing management of content, ensuring that the information on the intranet remains relevant, accurate, and up-to-date, requires a dedicated effort and a clear content governance strategy.

Given the potential for highly sensitive financial data to be involved, the process of data migration to a new intranet platform demands meticulous planning and careful execution to prevent any data loss or security breaches. Finance organizations must ensure that the chosen vendor has well-defined and robust data migration processes in place, along with stringent security protocols to safeguard confidential information during the transfer. Furthermore, achieving widespread user adoption among finance professionals, who may have a preference for more established and traditional communication methods, necessitates demonstrating the tangible benefits and overall value proposition of the new intranet platform. Effective communication strategies that highlight how the intranet can directly improve their efficiency, streamline collaboration on financial tasks, and enhance overall productivity, coupled with comprehensive and accessible training programs, are crucial for encouraging finance teams to fully embrace the new technology.

For financial institutions to achieve successful deployment of a social intranet SaaS product and realize its full potential for retaining and engaging key finance talent, selecting the right vendor is paramount. A creative and reliable vendor will possess a range of essential qualities tailored to the unique needs of the finance industry.

An essential quality of a suitable social intranet vendor is a deep and demonstrable understanding of the specific needs and challenges faced by organizations within the finance industry. This includes a clear appreciation for the stringent regulatory landscape, the critical importance of data security and compliance, and the specific operational requirements of finance teams. The vendor should also be knowledgeable about the various compliance standards relevant to the finance sector, such as GDPR, SOX, and other industry-specific regulations. A vendor with a proven track record of successfully working with financial services institutions is more likely to anticipate and effectively address the unique needs and potential challenges that finance teams may encounter during the deployment and ongoing use of a social intranet. Understanding the specific nuances of the finance industry, such as peak reporting periods, the necessity for comprehensive audit trails, and the sensitivity of financial data, is crucial for a vendor to provide a truly effective and valuable solution.

The social intranet vendor should offer a platform that provides extensive customization options, allowing the financial institution to align the intranet’s branding and features with its specific organizational culture and the unique workflows of its finance teams. Furthermore, the user interface of the platform should be highly intuitive and easy to navigate for all employees, regardless of their level of technical expertise or familiarity with social media-like platforms. Given that finance professionals often rely on a suite of specialized tools and software in their daily work, the ideal social intranet platform should offer customization capabilities that allow for seamless integration with these existing systems, creating a more unified and efficient user experience. Integrating with tools such as accounting software, financial reporting systems, and data analytics platforms can significantly enhance the value and encourage greater adoption of the social intranet among finance teams. Moreover, a highly user-friendly interface is crucial for driving widespread adoption across all levels of the finance department, including those individuals who may have less prior experience or comfort with social media-style communication platforms. Ease of use is a primary factor in ensuring that all finance employees, from junior analysts to senior executives, can readily and effectively utilize the social intranet for their daily communication, collaboration, and information-sharing needs.

A critical quality for any social intranet vendor serving the finance industry is a strong and unwavering commitment to data security and compliance. The vendor must demonstrate that their platform incorporates robust security measures, including end-to-end encryption of data, multi-factor authentication protocols, comprehensive access controls, and the implementation of regular and thorough security audits. Furthermore, the vendor should have a clear understanding of and fully comply with all relevant data privacy regulations, and their platform should offer features that directly support the financial institution’s compliance efforts. For finance organizations, the vendor’s security infrastructure and any relevant security certifications they hold, such as ISO 27001 or SOC 2, are critical indicators of their overall commitment to safeguarding sensitive data. These certifications provide a level of assurance, demonstrating that the vendor has undergone independent audits and adheres to recognized and rigorous security standards. Additionally, the vendor should offer granular access controls and permissions within the social intranet platform to ensure that any sensitive financial information that is shared is only accessible to those personnel within the finance organization who have a legitimate need to view it. Different roles and responsibilities within a finance department will naturally require access to varying levels and types of information, and the vendor should provide the flexibility and tools necessary to configure these access rights effectively and with precision.

A creative social intranet vendor should provide a platform that offers seamless integration capabilities with the financial institution’s existing suite of finance software, human resources management systems, and other essential business applications. This can be achieved through the provision of robust APIs (Application Programming Interfaces) and pre-built connectors that facilitate data exchange and interoperability between the social intranet and other critical systems. The goal of such integration should be to streamline existing workflows for finance teams, eliminating the need to switch between multiple disparate platforms and thereby avoiding the creation of data silos. Integration with HR systems is particularly important for finance teams, as it allows them to directly access essential employee data for tasks such as payroll processing, benefits administration, and the creation of organizational charts, all from within the familiar interface of the social intranet. Streamlining access to this HR-related information can significantly improve efficiency for finance professionals, who often handle these responsibilities or need to frequently refer to employee data. Furthermore, seamless integration with communication and collaboration platforms that are already widely used by finance teams, such as Microsoft Teams or Slack, can facilitate a much smoother transition to the new social intranet and encourage higher levels of user adoption. By integrating with these already familiar tools, the social intranet becomes a more natural and less disruptive extension of their existing daily workflow, which in turn reduces the initial learning curve and significantly increases overall user engagement with the platform.

A reliable social intranet vendor should offer comprehensive training programs tailored for both administrators who will manage the platform and the end-users within the financial institution who will be utilizing its features. This training should cover all aspects of the platform’s functionality and be delivered in formats that cater to different learning styles. Readily accessible and reliable technical support is another essential quality, ensuring that any issues or questions that arise during or after implementation are addressed promptly and effectively. Furthermore, the vendor should be committed to providing regular updates and ongoing maintenance for the social intranet platform to ensure that it remains secure, functional, and continues to meet the evolving needs of the financial institution. Given the critical nature of finance functions within an organization, the vendor’s technical support team should possess specific expertise in addressing any finance-related issues that may arise and be capable of ensuring minimal disruption to essential financial processes during any technical difficulties. Finance teams often operate on strict schedules and cannot afford prolonged periods of downtime for their communication and collaboration tools, especially during peak financial periods. Therefore, the vendor’s support services must be both highly responsive and thoroughly knowledgeable about the specific operational demands of the finance industry. Additionally, ongoing training resources and opportunities are essential to ensure that finance professionals can continuously leverage the full range of features offered by the social intranet platform and effectively adapt to any new updates or functionalities that may be introduced over time. Continuous learning is a fundamental aspect of professional development in the finance sector, and the vendor should provide easily accessible training materials, such as online tutorials, user guides, and webinars, to help finance teams maximize their utilization of the platform and stay informed about its latest capabilities.

The ideal social intranet vendor should demonstrate a clear vision for the future development of their platform, including a well-defined product roadmap that incorporates user feedback and anticipates emerging trends in technology and the finance industry. The vendor should also be responsive to the evolving needs of the finance sector, actively seeking to understand the changing regulatory landscape and technological advancements, and demonstrating a strong commitment to establishing a long-term partnership with the financial institution. As the finance industry continues to evolve at a rapid pace, driven by new technologies and shifting regulatory requirements, the chosen social intranet vendor should demonstrate a proactive commitment to innovation and continuously incorporate relevant features and functionalities into their platform to meet these future needs. Finance organizations require a social intranet platform that is not static but rather can adapt and grow alongside the industry’s ongoing transformation. Therefore, the vendor should be forward-thinking in their approach and actively strive to enhance their product with cutting-edge technologies and features that will benefit their finance clients. Furthermore, establishing a robust and enduring long-term partnership with the social intranet vendor is crucial for financial institutions to ensure they receive ongoing support, expert guidance, and a truly collaborative approach to maximizing the value and effectiveness of the platform over time. Implementing a social intranet is a significant investment for any organization, and a vendor that views the relationship as a genuine partnership, rather than just a transactional one, will be more deeply invested in the long-term success and satisfaction of the financial institution.

In conclusion, the retention of key finance talent is an increasingly critical imperative for financial organizations operating in today’s competitive and rapidly evolving business environment. The specialized skills, deep knowledge, and unwavering trust associated with experienced finance professionals are invaluable assets that are costly and challenging to replace. This report has explored a range of key strategies that financial institutions can implement to effectively retain and engage these vital employees.

The success of any retention strategy hinges on a holistic approach that recognizes the interconnectedness of various factors influencing employee satisfaction and commitment. Competitive and comprehensive compensation packages form a foundational element, ensuring that finance professionals feel fairly valued for their expertise and contributions. However, the quality of management plays an equally significant role, with effective managers providing the guidance, support, and developmental opportunities that foster growth and loyalty. Cultivating a workplace culture characterized by mutual respect and consistent recognition further enhances employee well-being and strengthens their connection to the organization. Implementing effective people management practices, including clear communication, well-defined expectations, and opportunities for advancement, creates an environment where finance professionals can thrive and reach their full potential. Finally, promoting a healthy work-life balance acknowledges the importance of employees’ personal lives and demonstrates an organizational commitment to their overall well-being, which is increasingly valued by today’s workforce.

This report has also underscored the strategic role that social intranets can play in bolstering talent retention within finance teams. These platforms offer powerful tools for enhancing communication and fostering seamless collaboration, breaking down silos and connecting employees regardless of their location. They provide valuable avenues for recognizing and appreciating the contributions of finance professionals, boosting morale and strengthening the overall company culture. Social intranets can also serve as central hubs for facilitating learning and development opportunities, ensuring that finance teams remain current with industry changes and have access to resources for professional growth. Furthermore, they create vital feedback channels, allowing employees to voice their opinions and fostering a greater sense of belonging and engagement. Finally, social intranet platforms can actively support work-life balance initiatives by streamlining communication and providing resources that help employees manage their time and well-being more effectively.

However, the successful implementation of a social intranet solution requires careful navigation of the SaaS procurement process. Financial institutions must be acutely aware of the common pitfalls and potential issues associated with purchasing SaaS products, including unclear requirements, integration challenges, security concerns, scalability limitations, and complex pricing structures. Understanding the reasons why organizations may experience regret after a SaaS purchase, such as misaligned expectations, hidden costs, and inadequate vendor support, is crucial for making informed decisions. Addressing the key challenges inherent in implementing social intranet SaaS solutions, including data migration, user adoption, training, and system integration, requires a well-thought-out strategy and a collaborative approach.

Ultimately, selecting a creative and reliable social intranet vendor is a critical determinant of successful SaaS deployment in the finance sector. The ideal vendor will possess a deep understanding of the unique needs and challenges of the finance industry, offer a customizable and user-friendly platform, prioritize the security and compliance of sensitive financial information, ensure seamless integration with existing systems, provide comprehensive training and ongoing support, and demonstrate a commitment to innovation and a long-term partnership.

The most effective strategies for retaining talent in the finance industry involve a comprehensive and multi-faceted approach that thoughtfully addresses both the tangible needs, such as competitive compensation and robust benefits, and the equally important intangible needs of employees, including a positive and respectful work environment, opportunities for professional growth and development, and a healthy balance between their work and personal lives. Investing in the right social intranet platform, with a clear and consistent focus on user experience, robust security measures, and features specifically tailored to the operational and collaborative needs of finance teams, can significantly contribute to fostering a more positive and engaging employee experience, ultimately leading to improved retention rates and a more stable and high-performing finance workforce within the financial services sector.

creativesocialintranet.com

Traits Of a Good Intranet Development Service Provider

Opens in a new window

creativesocialintranet.com

Workplace Is Shutting Down – What You Need to Do to Shift Your Intranet to a Reliable Vendor

ENGAGEMENT DRIVE PERFORMANCE